revenue / earnings growth? pls check it out b4 investing or trading

1) ELECTRICAL-POWER/EQUIPMT GROUP (53 STOCKS) AMSC: MANUFACTURES PROGRAMMABLE POWER ELECTRONIC CONVERTERS, AND HIGH TEMPERATURE SUPERCONDUCTOR WIRES

Composite Rating 80

GENERAL MARKET AND INDUSTRY GROUP (AMSC) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 70

FUNDAMENTAL PERFORMANCE (AMSC) Current Earnings

EPS Due Date 10/29/2010

EPS Rating 79

EPS % Chg (Last Qtr) 133%

Last 3 Qtrs Avg EPS Growth N/A N/A

# Qtrs of EPS Acceleration 1

EPS Est % Chg (Current Qtr) 47%

Estimate Revisions

Last Quarter % Earnings Surprise 16.7%

Annual Earnings

3 Yr EPS Growth Rate N/A N/A

Consecutive Yrs of Annual EPS Growth 3

EPS Est % Chg (Current Yr) 78.57%

Sales, Margin, ROE

SMR Rating A

Sales % Chg (Last Qtr) 33%

3 Yr Sales Growth Rate 78%

Annual Pre-Tax Margin 16.6%

Annual ROE 12.6%

Debt/Equity Ratio 0%

TECHNICAL PERFORMANCE (AMSC) Price And Volume

Price $34.54

RS Rating 55

% Off 52 Week High -21.4%

Price vs. 50-Day Moving Average 12.57%

50-Day Average Volume 632,900

Supply And Demand

Market Capitalization 1.57 B

Acc/Dis Rating B

Up/Down Volume 1.5

% Change In Funds Owning Stock 10%

Qtrs Of Increasing Fund Ownership 1

2) COMTECH TELECOMM CORP RANK WITHIN THE TELECOM-CABLE/SATL EQP GROUP (51 STOCKS)

CMTL: MANUFACTURES TELECOM/MOBILE DATA TRANSMISSION SYSTEMS AND RFMICROWAVE AMPLIFIERS FOR COMMERCIAL AND GOVERNMENT MARKETS.

Composite Rating 97

GENERAL MARKET AND INDUSTRY GROUP (CMTL) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 39

FUNDAMENTAL PERFORMANCE (CMTL) Current Earnings

EPS Due Date 12/08/2010

EPS Rating 88

EPS % Chg (Last Qtr) 248%

Last 3 Qtrs Avg EPS Growth 135%

# Qtrs of EPS Acceleration 3

EPS Est % Chg (Current Qtr) 103%

Estimate Revisions

Last Quarter % Earnings Surprise 25.9%

Annual Earnings

3 Yr EPS Growth Rate -21%

Consecutive Yrs of Annual EPS Growth 1

EPS Est % Chg (Current Yr) -9.5%

Sales, Margin, ROE

SMR Rating A

Sales % Chg (Last Qtr) 111%

3 Yr Sales Growth Rate 13%

Annual Pre-Tax Margin 14.2%

Annual ROE 10.6%

Debt/Equity Ratio 29%

TECHNICAL PERFORMANCE (CMTL) Price And Volume

Price $30.59

RS Rating 69

% Off 52 Week High -20.3%

Price vs. 50-Day Moving Average 22.28%

50-Day Average Volume 475,900

Supply And Demand

Market Capitalization 866.00 M

Acc/Dis Rating A

Up/Down Volume 2.3

% Change In Funds Owning Stock 1%

Qtrs Of Increasing Fund Ownership 2

3) ITRON INC RANK WITHIN THE ELEC-SCIENTIFIC/MSRNG GROUP (39 STOCKS)

ITRI: MANUFACTURES METERS AND AUTOMATED METER READING AND ADVANCEDMETERING INFRASTRUCTURE SOFTWARE FOR THE UTILITY MARKET.

Composite Rating 76

GENERAL MARKET AND INDUSTRY GROUP (ITRI) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 23

FUNDAMENTAL PERFORMANCE (ITRI) Current Earnings

EPS Due Date 10/28/2010

EPS Rating 94

EPS % Chg (Last Qtr) 100%

Last 3 Qtrs Avg EPS Growth 85%

# Qtrs of EPS Acceleration 0

EPS Est % Chg (Current Qtr) 88%

Estimate Revisions

Last Quarter % Earnings Surprise 34.2%

Annual Earnings

3 Yr EPS Growth Rate -4%

Consecutive Yrs of Annual EPS Growth 0

EPS Est % Chg (Current Yr) 73.11%

Sales, Margin, ROE

SMR Rating B

Sales % Chg (Last Qtr) 38%

3 Yr Sales Growth Rate 17%

Annual Pre-Tax Margin 4.8%

Annual ROE 6.7%

Debt/Equity Ratio 55%

TECHNICAL PERFORMANCE (ITRI) Price And Volume

Price $60.14

RS Rating 25

% Off 52 Week High -26.6%

Price vs. 50-Day Moving Average 2.24%

50-Day Average Volume 401,600

Supply And Demand

Market Capitalization 2.43 B

Acc/Dis Rating B

Up/Down Volume 1

% Change In Funds Owning Stock -4%

Qtrs Of Increasing Fund Ownership 0

4) AEGEAN MARINE PETROLEUM RANK WITHIN THE OIL&GAS-REFINING/MKTG GROUP (42 STOCKS)

ANW: SUPPLIES AND MARKETS REFINED MARINE FUEL AND LUBRICANTS TO THE WORLDWIDE SHIPPING INDUSTRY.

Composite Rating 52

GENERAL MARKET AND INDUSTRY GROUP (ANW) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 51

FUNDAMENTAL PERFORMANCE (ANW) Current Earnings

EPS Due Date 11/11/2010

EPS Rating 92

EPS % Chg (Last Qtr) 7%

Last 3 Qtrs Avg EPS Growth 74%

# Qtrs of EPS Acceleration 0

EPS Est % Chg (Current Qtr) 6%

Estimate Revisions

Last Quarter % Earnings Surprise -16.7%

Annual Earnings

3 Yr EPS Growth Rate 26%

Consecutive Yrs of Annual EPS Growth 4

EPS Est % Chg (Current Yr) 28.03%

Sales, Margin, ROE

SMR Rating B

Sales % Chg (Last Qtr) 146%

3 Yr Sales Growth Rate 46%

Annual Pre-Tax Margin 1.8%

Annual ROE 14.7%

Debt/Equity Ratio 101%

TECHNICAL PERFORMANCE (ANW) Price And Volume

Price $16.95

RS Rating 3

% Off 52 Week High -51.6%

Price vs. 50-Day Moving Average 2.05%

50-Day Average Volume 568,900

Supply And Demand

Market Capitalization 791.00 M

Acc/Dis Rating C-

Up/Down Volume 0.6

% Change In Funds Owning Stock -2%

Qtrs Of Increasing Fund Ownership 0

5) VEECO INSTRUMENTS INC RANK WITHIN THE ELEC-SCIENTIFIC/MSRNG GROUP (39 STOCKS)

VECO: MANUFACTURES METAL ORGANIC CHEMICAL VAPOR/ION BEAM DEPOSI TION SYSTEMS AND ATOMIC FORCE/SCANNING PROBE MICROSCOPES

Composite Rating 80

GENERAL MARKET AND INDUSTRY GROUP (VECO) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 23

FUNDAMENTAL PERFORMANCE (VECO) Current Earnings

EPS Due Date 10/26/2010

EPS Rating 79

EPS % Chg (Last Qtr) 773%

Last 3 Qtrs Avg EPS Growth N/A N/A

# Qtrs of EPS Acceleration 3

EPS Est % Chg (Current Qtr) 681%

Estimate Revisions

Last Quarter % Earnings Surprise 21.7%

Annual Earnings

3 Yr EPS Growth Rate N/A N/A

Consecutive Yrs of Annual EPS Growth 0

EPS Est % Chg (Current Yr) 1396.42%

Sales, Margin, ROE

SMR Rating B

Sales % Chg (Last Qtr) 251%

3 Yr Sales Growth Rate 5%

Annual Pre-Tax Margin 3.7%

Annual ROE 3.1%

Debt/Equity Ratio 28%

TECHNICAL PERFORMANCE (VECO) Price And Volume

Price $38.26

RS Rating 40

% Off 52 Week High -29.8%

Price vs. 50-Day Moving Average 8.87%

50-Day Average Volume 2,406,800

Supply And Demand

Market Capitalization 1.56 B

Acc/Dis Rating B-

Up/Down Volume 0.9

% Change In Funds Owning Stock -8%

Qtrs Of Increasing Fund Ownership 0

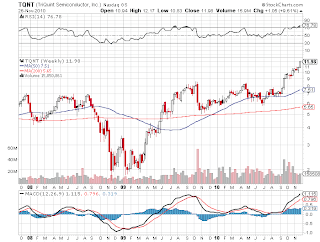

6) POWER ONE INC RANK WITHIN THE ELECTRICAL-POWER/EQUIPMT GROUP (53 STOCKS)

PWER: MANUFACTURES AC/DC AND DC/DC CONVERTERS AND RENEWABLE ENERGYINVERTERS FOR TELECOM AND INFRASTRUCTURE MARKETS.

Composite Rating 89

GENERAL MARKET AND INDUSTRY GROUP (PWER) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 70

FUNDAMENTAL PERFORMANCE (PWER) Current Earnings

EPS Due Date 10/22/2010

EPS Rating 79

EPS % Chg (Last Qtr) 313%

Last 3 Qtrs Avg EPS Growth N/A N/A

# Qtrs of EPS Acceleration 0

EPS Est % Chg (Current Qtr) 866%

Estimate Revisions

Last Quarter % Earnings Surprise 70.0%

Annual Earnings

3 Yr EPS Growth Rate N/A N/A

Consecutive Yrs of Annual EPS Growth 2

EPS Est % Chg (Current Yr) N/A N/A

Sales, Margin, ROE

SMR Rating C

Sales % Chg (Last Qtr) 135%

3 Yr Sales Growth Rate 1%

Annual Pre-Tax Margin 0.9%

Annual ROE 0.0%

Debt/Equity Ratio 64%

TECHNICAL PERFORMANCE (PWER) Price And Volume

Price $10.19

RS Rating 99

% Off 52 Week High -21.9%

Price vs. 50-Day Moving Average 0.88%

50-Day Average Volume 6,149,000

Supply And Demand

Market Capitalization 1.08 B

Acc/Dis Rating B-

Up/Down Volume 0.8

% Change In Funds Owning Stock 59%

Qtrs Of Increasing Fund Ownership 2

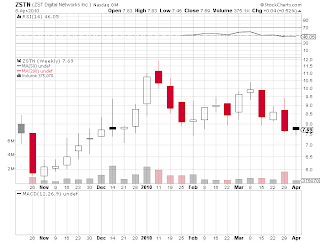

7) RIVERBED TECHNOLOGY INC RANK WITHIN THE COMPUTER-NETWORKING GROUP (32 STOCKS)

RVBD: PROVIDES PRODUCTS AND SERVICES THAT IMPROVE APPLICATIONS ANDACCESSIBILITY OF DATA OVER WIDE AREA NETWORKS.

Composite Rating 99

GENERAL MARKET AND INDUSTRY GROUP (RVBD) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 27

FUNDAMENTAL PERFORMANCE (RVBD) Current Earnings

EPS Due Date 02/02/2011

EPS Rating 97

EPS % Chg (Last Qtr) 79%

Last 3 Qtrs Avg EPS Growth 70%

# Qtrs of EPS Acceleration 2

EPS Est % Chg (Current Qtr) 42%

Estimate Revisions

Last Quarter % Earnings Surprise 21.4%

Annual Earnings

3 Yr EPS Growth Rate 16%

Consecutive Yrs of Annual EPS Growth 1

EPS Est % Chg (Current Yr) 50%

Sales, Margin, ROE

SMR Rating A

Sales % Chg (Last Qtr) 39%

3 Yr Sales Growth Rate 30%

Annual Pre-Tax Margin 19.4%

Annual ROE 15.5%

Debt/Equity Ratio 0%

TECHNICAL PERFORMANCE (RVBD) Price And Volume

Price $45.87

RS Rating 97

% Off 52 Week High -6.0%

Price vs. 50-Day Moving Average 9.06%

50-Day Average Volume 2,292,400

Supply And Demand

Market Capitalization 3.33 B

Acc/Dis Rating B-

Up/Down Volume 1.7

% Change In Funds Owning Stock 8%

Qtrs Of Increasing Fund Ownership 1

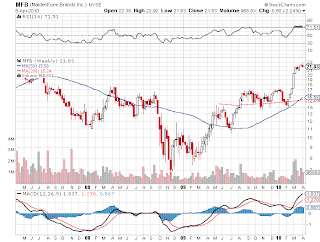

8) GRAND CANYON EDUCATION RANK WITHIN THE CONSUMER SVCS-EDUCATION GROUP (32 STOCKS)

LOPE: OFFERS POST-SECONDARY EDUCATION PROGRAMS FOR 37,700 STUDENTSVIA AN ONLINE PROGRAM AND ITS ARIZONA CAMPUS.

Composite Rating 54

GENERAL MARKET AND INDUSTRY GROUP (LOPE) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 185

FUNDAMENTAL PERFORMANCE (LOPE) Current Earnings

EPS Due Date 11/03/2010

EPS Rating 99

EPS % Chg (Last Qtr) 59%

Last 3 Qtrs Avg EPS Growth 245%

# Qtrs of EPS Acceleration 0

EPS Est % Chg (Current Qtr) 93%

Estimate Revisions

Last Quarter % Earnings Surprise 12.5%

Annual Earnings

3 Yr EPS Growth Rate 326%

Consecutive Yrs of Annual EPS Growth 4

EPS Est % Chg (Current Yr) 81.15%

Sales, Margin, ROE

SMR Rating A

Sales % Chg (Last Qtr) 55%

3 Yr Sales Growth Rate 61%

Annual Pre-Tax Margin 19.7%

Annual ROE 44.8%

Debt/Equity Ratio 31%

TECHNICAL PERFORMANCE (LOPE) Price And Volume

Price $20.24

RS Rating 23

% Off 52 Week High -28.9%

Price vs. 50-Day Moving Average 4.61%

50-Day Average Volume 527,000

Supply And Demand

Market Capitalization 926.00 M

Acc/Dis Rating D+

Up/Down Volume 0.8

% Change In Funds Owning Stock 6%

Qtrs Of Increasing Fund Ownership 2

9) CTRIP.COM INTL LTD ADR RANK WITHIN THE LEISURE-TRAVEL BOOKING GROUP (9 STOCKS)

CTRP: CHINA-BASED CONSOLIDATOR OF HOTEL ACCOMMODATIONS AND AIRLINETICKETS TARGETING INDIVIDUAL BUSINESS AND LEISURE TRAVELERS.

Composite Rating 99

GENERAL MARKET AND INDUSTRY GROUP (CTRP) General Market

Market in confirmed uptrend

Industry Group

Industry Group Rank 2

FUNDAMENTAL PERFORMANCE (CTRP) Current Earnings

EPS Due Date 11/11/2010

EPS Rating 99

EPS % Chg (Last Qtr) 53%

Last 3 Qtrs Avg EPS Growth 50%

# Qtrs of EPS Acceleration 0

EPS Est % Chg (Current Qtr) 9%

Estimate Revisions

Last Quarter % Earnings Surprise 38.1%

Annual Earnings

3 Yr EPS Growth Rate 36%

Consecutive Yrs of Annual EPS Growth 4

EPS Est % Chg (Current Yr) 17.07%

Sales, Margin, ROE

SMR Rating A

Sales % Chg (Last Qtr) 47%

3 Yr Sales Growth Rate 38%

Annual Pre-Tax Margin 45.1%

Annual ROE 32.0%

Debt/Equity Ratio 0%

TECHNICAL PERFORMANCE (CTRP) Price And Volume

Price $51.01

RS Rating 94

% Off 52 Week High -0.7%

Price vs. 50-Day Moving Average 15.44%

50-Day Average Volume 1,633,800

Supply And Demand

Market Capitalization 6.85 B

Acc/Dis Rating B+

Up/Down Volume 1.6

% Change In Funds Owning Stock 3%

Qtrs Of Increasing Fund Ownership 6